Real-World Success Stories: How Businesses Save Time and Money with Receipt Hunter

The Problem: Why Businesses Struggle with Manual Receipt Management

For small and medium-sized businesses (SMBs), especially in the construction industry, manual receipt management is a bottleneck that drains resources, increases costs, and reduces financial accuracy. Traditional bookkeeping methods involve paper receipts, manual data entry, and complex reconciliations. According to a 2024 Small Business Accounting Report, nearly 68% of SMBs report inefficiencies in receipt tracking, leading to financial losses and missed tax deductions.

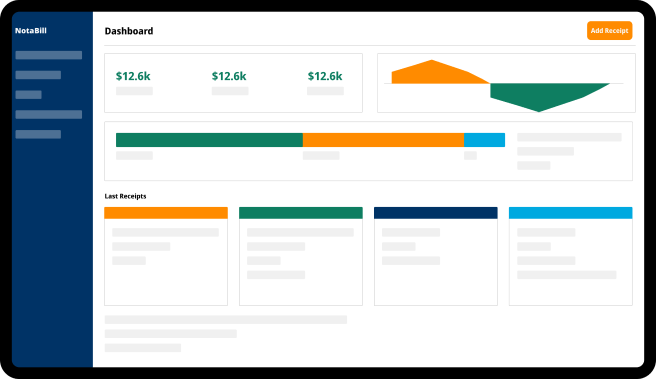

The Solution: How Receipt Hunter Transforms Expense Management

Receipt Hunter is designed to streamline receipt collection, processing, and integration with accounting software for small businesses like QuickBooks. By automating receipt tracking, businesses can cut administrative costs, enhance accuracy, and improve financial decision-making while keeping full control over bookkeeping.

Case Study 1: A Construction Firm Saves 120 Hours per Month

Company: StoneBuild Contractors (50 employees)

Challenge: Managing hundreds of receipts from suppliers, subcontractors, and material purchases across multiple projects. The finance team spent over 30 hours per week manually entering data.

Solution: Implementing Receipt Hunter automated receipt processing, categorization, and direct integration with QuickBooks.

Results:

-

Reduced data entry time by 85%, saving 120 hours per month.

-

Eliminated manual errors that previously led to $10,000 in tax deductions being overlooked.

-

Improved real-time tracking of expenses, allowing project managers to stay within budget.

Case Study 2: A Small Retail Business Cuts Bookkeeping Costs by 40%

Company: GreenLeaf Organic Market

Challenge: Tracking daily receipts from multiple suppliers and reconciling expenses manually led to discrepancies and missed invoice payments.

Solution: With Receipt Hunter’s small business accounting software integration, GreenLeaf automated the collection and categorization of receipts, ensuring every transaction was logged correctly.

Results:

-

Reduced bookkeeping expenses by 40%.

-

Improved supplier payment accuracy, avoiding late fees and penalties.

-

Increased tax compliance and maximized deductions.

Why Automation is No Longer Optional

The landscape of accounting platforms is shifting rapidly. Businesses that rely on manual bookkeeping are at a competitive disadvantage. The automation of receipt collection reduces operational inefficiencies, enhances financial visibility, and ensures compliance with tax regulations, while accountants and bookkeepers maintain full control over financial decisions.

Key Benefits of Receipt Hunter for SMBs:

-

Time Savings: Eliminates manual data entry and streamlines expense tracking.

-

Cost Efficiency: Reduces the need for additional bookkeeping staff.

-

Financial Accuracy: Minimizes human errors and ensures every expense is accounted for.

-

Scalability: Supports businesses as they grow, handling increased transaction volumes seamlessly.

The Future of Automated Accounting

Accounting tools for small business bookkeeping will continue to evolve, integrating real-time financial insights and seamless compatibility with accounting platforms. Companies that invest in automation now will have a strategic advantage in financial efficiency and operational agility.

Conclusion: Is Your Business Ready for Automation?

With SMBs facing increasing financial complexities, the adoption of automated receipt management like Receipt Hunter is not just a luxury—it’s a necessity. Businesses that transition to automated receipt tracking today will reap long-term cost savings, improved accuracy, and enhanced productivity while ensuring full human oversight of bookkeeping processes.

Are you ready to revolutionize your expense tracking? Try Receipt Hunter and experience the future of automated bookkeeping firsthand.