How Construction Companies in the U.S. Lose Money Due to Poor Receipt Management – And How to Fix It

The Hidden Costs of Small Purchases in Construction

Construction companies operating in the U.S. often face a unique financial challenge: managing small, frequent purchases across multiple job sites. With a large workforce, including supervisors, assistants, and contractors, tracking every transaction becomes a logistical nightmare.

The result? Lost receipts, unaccounted expenses, financial penalties, and profit erosion. When receipts aren’t properly documented, businesses risk facing IRS penalties, inaccurate bookkeeping, and cash flow problems. Implementing the best accounting software for small businesses is critical for financial accuracy.

Common Problems Construction Firms Face

1. High Volume of Small Purchases

-

Materials, tools, and supplies are bought daily from different vendors.

-

Purchases made by various employees across different job sites.

-

Lack of a centralized receipt management system.

2. No Standardized Process for Receipts

-

Workers often forget to keep receipts.

-

Paper receipts get lost or damaged.

-

No accountability on who made the purchase.

-

Missing transactions result in inaccurate financial records, affecting bookkeeping software for small businesses.

3. Financial Repercussions

-

IRS audits can result in penalties for missing financial records.

-

Budget overruns due to untracked expenses.

-

Inaccurate reporting leads to tax inefficiencies and lost deductions.

-

Limited visibility into financial operations affects decision-making.

Exploring Possible Solutions

Option 1: Hire a Full-Time Expense Manager

One way to address this issue is by hiring an employee solely responsible for tracking expenses. This person would:

-

Collect and record receipts from every worker.

-

Ensure proper documentation before reimbursements.

-

Maintain organized financial records using accounting platforms.

Pros:

✅ Ensures human oversight.

✅ Provides a clear point of accountability.

Cons:

❌ Additional salary expenses.

❌ Still reliant on employees manually submitting receipts.

❌ Not scalable for larger companies.

Option 2: Do Nothing and Accept the Losses

Some companies simply accept the financial leakage as a cost of doing business. This approach acknowledges that:

-

It’s difficult to track every small transaction.

-

Some financial loss is inevitable.

-

Time spent collecting receipts may outweigh the benefits.

Pros:

✅ No additional investment required.

Cons:

❌ Ongoing financial waste.

❌ Increased risk of tax penalties and audits.

❌ Loss of potential tax deductions.

❌ Reduces profitability over time.

Option 3: Automate Receipt Collection and Expense Management (The Best Solution)

![]()

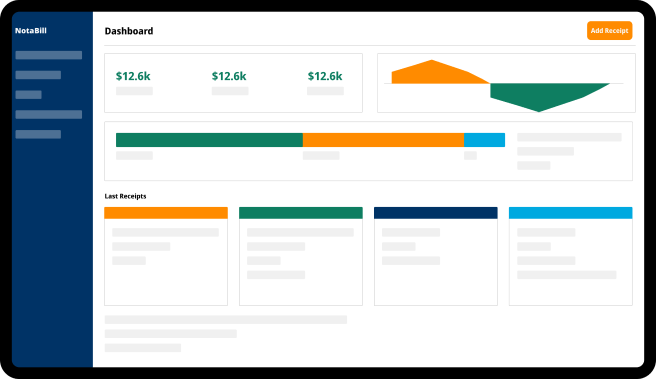

The most efficient and cost-effective approach is to implement an automated receipt collection system that integrates directly with best accounting software for small businesses. A solution like this:

-

Automatically tracks purchases and assigns them to the correct project.

-

Notifies employees to submit receipts immediately after a purchase.

-

Digitally captures and categorizes receipts to prevent loss.

-

Syncs all financial data into QuickBooks for seamless bookkeeping.

-

Ensures compliance with financial regulations and tax requirements.

-

Provides real-time oversight for business owners and financial teams.

Introducing a Smarter Solution

Instead of struggling with manual receipt tracking or hiring extra personnel, companies can leverage a fully automated system like Receipt Hunter. This software simplifies receipt collection, ensuring that every expense is properly logged, categorized, and integrated into accounting platforms.

Receipt Hunter offers:

-

Real-Time Expense Tracking: Know exactly who made each purchase and when.

-

Automated Reminders: Employees receive prompts to submit receipts instantly.

-

Cloud-Based Storage: No more lost paper receipts or manual filing.

-

Seamless QuickBooks Integration: Ensuring your financial records remain up-to-date.

Pros:

✅ Eliminates manual tracking errors.

✅ Saves time for employees and managers.

✅ Ensures every purchase is accounted for, improving financial accuracy.

✅ Reduces tax penalties and increases potential deductions.

✅ Increases efficiency with expense tracking software.

✅ Provides a scalable, long-term solution for business growth.

Cons:

❌ Requires an initial investment in software.

❌ Employees need basic training to use the system.

❌ Some resistance to change may occur.

Conclusion: The Future of Expense Management in Construction

For construction firms looking to reduce unnecessary financial losses, investing in best bookkeeping software for small businesses is no longer optional—it’s a necessity. The traditional approach of manual tracking is outdated and prone to human error, while ignoring the problem altogether leads to continuous financial losses.

With an automated receipt management system in place, businesses can ensure accurate bookkeeping, prevent IRS penalties, and ultimately increase profitability. If your company is still struggling with lost receipts, maybe it’s time to upgrade to a smarter solution.

Companies that implement accounting platforms and expense tracking software gain a competitive advantage in financial control, ensuring that every transaction is properly recorded, categorized, and optimized for tax savings.

Don’t let lost receipts drain your profits. Invest in an automated system like Receipt Hunter today and take control of your financial future.