Expense Management: How Automation Prevents Penalties and Optimizes Budgets

The High Cost of Poor Expense Management

Small and medium-sized businesses (SMBs) and construction firms often struggle with managing their expenses effectively. Paper receipts get lost, manual entry leads to errors, and late payments result in financial penalties. According to a 2024 Small Business Financial Report, nearly 30% of SMBs incur unnecessary fines due to poor expense tracking.

The cost isn’t just financial—it’s operational inefficiency, wasted labor, and missed tax deductions. But the right automation tools can transform expense management, reducing compliance risks and improving budget accuracy.

The Impact of Automated Expense Tracking

1. Avoiding Late Payment Penalties

Missing payment deadlines isn’t just about late fees—it impacts vendor relationships and credit scores. Accounting software for small businesses that integrates automated receipt tracking ensures that every transaction is logged in real-time. By setting up automated reminders and scheduled payments, companies can prevent costly delays.

2. Eliminating Manual Errors That Lead to Overspending

Data entry mistakes, duplicate receipts, and untracked expenses can inflate operational costs. Automated best bookkeeping software for small businesses eliminates these risks by categorizing expenses correctly, flagging duplicate entries, and syncing with bank accounts for real-time oversight.

3. Maximizing Tax Deductions

Lost receipts mean lost deductions. A receipt management system ensures that every deductible expense is accounted for, reducing taxable income and optimizing financial reporting. Businesses using automated tracking solutions have reported an 8-12% increase in tax savings due to improved record-keeping.

Case Study: A Construction Firm Saves $15,000 Annually

Company: BuildRight Construction (75 employees)

Challenge: Misplaced receipts and manual entry errors led to tax reporting inconsistencies and frequent cash flow shortages.

Solution: Implementing an automated expense management system with real-time receipt tracking and budget forecasting.

Results:

-

Eliminated $5,000 in late fees.

-

Recovered $7,500 in lost tax deductions.

-

Improved cash flow predictability, reducing budget variances by 20%.

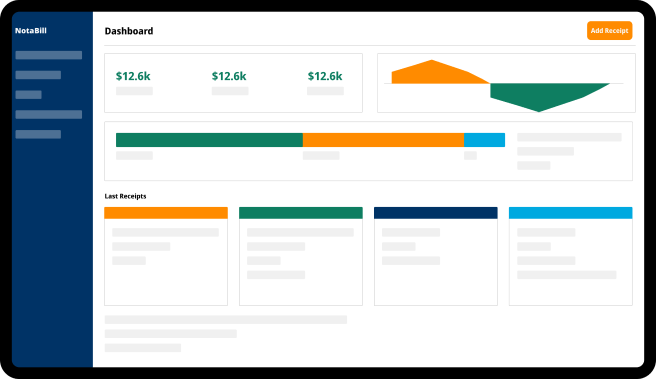

Why Automation Is a Game-Changer for SMBs

The rise of accounting platforms with built-in automation is leveling the playing field for SMBs. Businesses no longer need dedicated finance teams to manage receipts and expenses. Instead, they can rely on cost-effective bookkeeping tools that optimize budget management and financial oversight.

Key Benefits of Automated Expense Tracking:

-

Time Savings: Reduces administrative workload by up to 70%.

-

Cost Efficiency: Prevents penalties and optimizes resource allocation.

-

Financial Transparency: Real-time tracking provides instant budget visibility.

-

Scalability: Grows with business needs, handling increased transaction volumes seamlessly.

Looking Ahead: The Future of Expense Automation

With ongoing advancements in best accounting software for small businesses, companies can expect more intuitive, AI-driven insights for financial planning. While human oversight remains essential, automated tools will continue to drive efficiency, ensuring businesses maintain financial health without unnecessary risks.

Conclusion: A Smarter Approach to Budget Control

Automating expense management isn’t about replacing accountants—it’s about empowering them with better tools. SMBs and construction firms that implement automated receipt collection and tracking can reduce penalties, improve financial accuracy, and optimize their budgets for long-term success.

Is your business ready to take control of its expenses? Explore automation solutions today and start optimizing your financial future.