Automating Receipt Collection: How Automation Reduces Business Costs by $20,000 Annually

The Hidden Cost of Manual Receipt Management

Every year, small and medium-sized businesses (SMBs) lose thousands of dollars due to inefficient receipt collection and bookkeeping processes. Construction firms, which deal with high transaction volumes and multiple suppliers, face an even greater financial burden. Despite the availability of small business accounting software, many companies still rely on outdated manual methods, leading to increased labor costs, missed tax deductions, and financial mismanagement.

A study by the National Small Business Association found that businesses spend an average of 120 hours per year on bookkeeping tasks. This translates into lost productivity and unnecessary expenses. But what if automation could cut this down by 75%?

Why Businesses Need Automated Accounting Solutions

1. Reducing Human Errors and Increasing Efficiency

Manually processing receipts leads to data entry mistakes, misplaced invoices, and reconciliation issues. Best accounting software for small businesses now includes AI-driven automation that can scan, categorize, and upload receipts directly into accounting platforms. By eliminating human error, businesses improve financial accuracy while reducing compliance risks.

2. Cost Savings: A $20,000 Per Year Opportunity

Let’s break down the potential savings:

-

Labor Reduction: Automating bookkeeping can reduce the need for full-time data entry personnel, saving an average of $12,000 per year.

-

Tax Optimization: Missed receipts lead to lost tax deductions. Businesses that implement automated tracking reclaim an estimated $5,000 annually.

-

Operational Efficiency: Faster processing prevents late fees, duplicate payments, and missed financial opportunities, contributing to an additional $3,000 in savings.

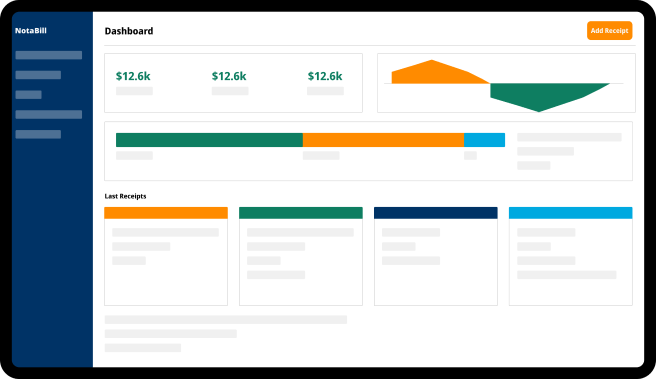

3. Seamless Integration with QuickBooks

For businesses using best bookkeeping software for small businesses, seamless integration with QuickBooks ensures real-time financial tracking. Automated systems extract key details from receipts and match them with transactions, providing an up-to-date view of cash flow.

The Construction Industry’s Unique Accounting Challenges

Construction businesses operate on a job-costing model, where every project has its own budget, expenses, and profitability metrics. Managing accounts payable software manually in this environment is inefficient and prone to financial leakage. Automated solutions streamline procurement, ensure timely reimbursements, and maintain compliance with industry regulations.

Key Features to Look for in Receipt Automation Software

When selecting an automation solution, businesses should prioritize:

-

AI-Powered Scanning & OCR: Converts paper receipts into digital records.

-

Cloud-Based Storage: Eliminates the risk of lost invoices.

-

Multi-Platform Compatibility: Works across desktops and mobile devices.

-

Automated Expense Categorization: Reduces the time spent on manual sorting.

Future Trends in Automated Accounting

As AI advances, accounting software for small business will further evolve, incorporating predictive analytics, voice recognition for expense logging, and blockchain for secure transactions. Businesses that adopt these technologies now will gain a competitive edge in cost efficiency and financial transparency.

Final Thoughts

SMBs and construction firms that embrace automated receipt collection can significantly reduce costs, enhance accuracy, and free up valuable resources. By integrating AI-driven accounting platforms, businesses can optimize financial operations, ensuring sustainable growth in an increasingly competitive landscape.

For those still managing receipts manually, the question isn’t if automation should be adopted—it’s how soon it can be implemented to start saving money today.